Mixed Messages Amidst Tough Trade Realities

Depending on the source, tariff talks are either going great or not happening at all, which is just adding more pain to corporations already struggling with an intensely opaque economic outlook.

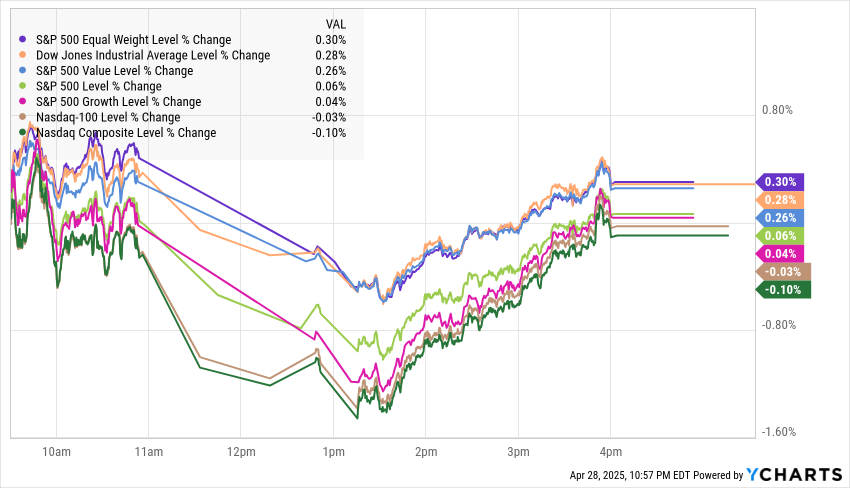

Monday, the S&P 500 was able to shake off some of its intraday weakness to finish relatively unchanged. Treasurys saw a bull-steepening, with the 2- and 30-year yields falling seven and five basis points, respectively, to 3.67% and 4.69%. Gold rose to close at $3,348 an ounce while bitcoin stayed just under $95,000. The VIX volatility index ended the day at 25.2, up just 1.3%, after rising to 27 midday.

Utilities and Real Estate were the top sector performers, while just three sectors ended the day lower: Consumer Discretionary, Consumer Staples, and Tech.

The S&P 500 was down 11.2% month-to-date at its closing low on April 8th, but it has rallied back 11% from those lows. As of Monday’s close, the index was down 1.5% since March’s close. In the S&P 500's history, since the five-day trading week began in late 1952, the index has never fully reversed a 10%+ intra-month drop (on a closing basis) to finish the month higher. Could this be a month for the record books?

In other good news, US stocks have underperformed their global counterparts by the most since 1993.

Despite the recent gains, the first 100 days of the Trump presidency (as of April 25th) saw the biggest drawdown (-8% for the S&P 500) in fifty years, going all the way back to President Ford in 1974.

This week, about 40% of the S&P 500 report earnings for the most recent quarter. Of the S&P 500 companies that have already provided results for this reporting season, over 90% have mentioned “tariffs” as a concern, and 44% mentioned “recession,” compared to less than 3% in the fourth quarter. Since the start of the quarter, EPS estimates have risen to +9.7% on expectations for an increase in spending ahead of the tariffs.

Tariff Impacts

Cargo shipments from China to the U.S. have already plunged by around 60% this month. The shelves at the major U.S. retailers will likely start showing the impact in the coming weeks, and the shortages will begin working through supply chains, leading to the widely anticipated price shocks. Next up, financial distress in small to mid-sized companies that are less able to absorb the shocks will lead to insolvencies and layoffs.

There are some seriously uncomfortable realities for the administration regarding trade with China, as it controls 90% of the world’s rare-earth metals supply. The US relies on China for 72% of the 17 rare-earth metals that go into everything from glass to catalytic converters, semiconductors, drones, and EVs, never mind all the critical components for aerospace. Add to that little conundrum that China is also the dominant player in the refining and processing of rare-earth metals. Then there is the primary material used in a battery’s anode, graphite. In 2023, China mined over 75% of the world’s graphite. This is not exactly an easy battle for the US.

What progress is being made is entirely unknown. Treasury Secretary Scott Bessent told ABC’s “This Week” that he did not know of any conversations between President Trump and President Xi Jinping. President Trump told Time magazine last week that he has spoken with Xi “numerous times.” In a news conference on Friday, Guo Jiakun, the spokesman for China’s Foreign Ministry said “China and the U.S. have not held consultations or negotiations on the issue of tariffs,” and “the United States should not confuse the public… any claims about progress in China-U.S. economic and trade negotiations are baseless rumors without factual evidence.” That’s a lot of mixed messages and confusion for corporations trying to make decisions.

Add to this that the latest poll (conducted between April 18th and 22nd) by The Washington Post-ABC News-Ipsos found that over the past two months, President Trump’s approval rating has dropped from 45% to 39%, and the disapproval rating has risen from 53% to 55%. This is a new record low for any President in history after their first 100 days in office for either their first or second term. In a Fox News poll released last week, just 37% approved of the President’s handling of economic matters, while 56% disapproved. The lower the approval rating, the more challenging it will be for the administration to push its agenda through Congress, which could mean more policy through executive order, which means even more uncertainty.

That approval rating could worsen once households feel the tariffs’ impact. The proposed rates as of April 15th will increase the effective tariff rate in the U.S. from less than 3% to 27%, the highest rate since 1903. According to the Budget Lab at Yale, this will result in an average per-household consumer loss of $4,700 in 2024 dollars and a loss of 740,000 jobs.

More Economic Red Flags

More recessionary warning flags came from the Dallas Fed’s manufacturing activity diffusion index, with a brutal contractionary reading of -35.8 in April from -16.3 in March. This was more than twice as bad as the consensus expectation for -17.0. April marks the third consecutive month of negative readings, and left the index at its most depressed level since May 2020. The six-month forward has repeatedly declined from +7.7 in February to -6.6 in March to -15.2 in April. The workweek (-6.4), employment (-3.9), new orders (-20.0), and shipments (-5.5) all contracted.

Inflationary factors were mixed. On the disinflation side, capacity utilization (-3.8), vendor delivery delays (-9.3), and backlogs (-13.4) all contracted. Vendor delays and backlogs hit six and five-month lows, respectively. Hiring plans for the next six months dropped to the lowest level since June 2024, and wage hike plans are down to levels not seen since June 2020. On the inflationary side, price hikes reached a ten-month high, rising to +14.9 from +6.3 in March as companies look to get ahead of the impact of tariffs.

We’ve now received all five regional Fed manufacturing PMIs, and overall, the outlook is extremely weak. It is deteriorating at the fastest pace in over 20 years, excluding the Global Financial Crisis and the pandemic. The difference here is that no clear fiscal or monetary white knights are on the horizon to fire up activity.

The Bloomberg Economics consensus is now up to 45% recession odds for the coming year, up from 30% a month ago, and Polymarket puts the chances of a U.S. recession at 56%.

Kalshi sees recession risks have risen from 19% the day before the inauguration to 57% as of Monday morning.

The C-suite is also raising flags:

When he spoke about expectations of lower revenue in the second quarter, Robert Jordan, the CEO of Southwest Airlines, said, "I don't care if you call it a recession or not. In this industry, that's a recession."

Jamie Caulfield, PepsiCo's CFO, said on his company's first-quarter earnings call, "Relative to where we were three months ago, we probably aren't feeling as good about the consumer now."

CEO of Chipotle, Scott Boatwright, during his company’s first-quarter earnings call, said, "Saving money because of concerns around the economy was the overwhelming reason consumers were reducing the frequency of restaurant visits.”

Spring’s Magic

One of my favorite things about spring is watching the bees scurry from flower to flower, and I just learned that bees sometimes hold “hands” when they sleep and need 5-8 hours of sleep! Sleep is vital for their memory consolidation and immune function, just like it is for ours.

There is nothing quite like the spring's first bloom of rose bushes. Each morning, I watch as more and more buds stretch open their delicate petals to the soft morning light, creating blankets of delicate white across my garden.

Some days it is easy to feel like the world is doing the proverbial “going to hell,” but then I step outside, hear the chorus of birds, smell the sweet scent of jasmine, and remember that life is still full of wonder and beauty, and the day’s headlines lose their importance.