GDP worse than expected, but actually better than it looks

Consumer spending was solid in Q1, but households aren't feeling the love

It has been a pretty big week on the economic data front, but the biggest news was the contraction of -0.3% in GDP in Q1, following the 2.4% increase in Q4 2024. This was the first decline in GDP since 2022 and was worse than expected. The decline was driven in large part by a buildup in imports of goods, which rose 41% annualized ahead of the tariffs.

The major equity indices opened deep in the red and fell further during early trading, but they were able to muster a rally into the close, possibly because, as analysts dug into the details, those GDP numbers weren’t as bad as they looked—more below.

While the market has improved since the initial tariff tantrums, after the first four months of 2025, equities are still struggling with the Dow down -4.4%, the S&P 500 down -5.3%, the Nasdaq down -9.7%, and the Russell 2000 down -11.4%.

Today’s inflation data ought to make the Federal Reserve happy. The core PCE deflator was flat MoM, versus consensus expectations for +0.1%, while YoY slowed from +3.0% to +2.6%. Fed Chair Powell’s favorite metric, “super core,” was also flat for the first time since April 2020.

US Dollar Weakness May Be Good News For Equities

The US dollar has declined 7.8% over the past two months, the largest two-month decline since 2002 and the seventh-largest decline over any two months going back to 1973. In all but one of the prior instances following a dollar decline of 7.8% or more, the S&P 500 was stronger three, six, and twelve months later, with an average one-year gain of 11.9%.

Trade Deficit Slams Q1 GDP

Tuesday, the Census reported preliminary goods trade data for March, and the massive increase in the US trade deficit has continued through Q1. The goods-only trade deficit was 12% more negative than expected and was a record high for March. Consumer goods imports have skyrocketed to get ahead of the tariffs, which means that the widening trade deficit is being driven by timing, so it should reverse dramatically in Q2. The 60%+ decline in container ships from China to the US that I wrote about here likely means that the US will shortly see a massive reversal in the trade deficit to a surplus and a corresponding lack of imports.

Consumer Spending Not As Great As The Headlines

For Q1, consumer spending was focused on non-cyclical areas: health care (+4.1%), housing/utilities (+3.4%), and groceries (+2.5%). These are must-haves, not like-to-haves. Spending on big-ticket durable goods declined at a -3.4% annual rate, the steepest decline since 2021Q3. On the services side, the most cyclical of all, restaurants and accommodation, declined by 2.1% (annualized).

Massive Capex Surprise

The biggest surprise came from business capex, which soared +22.5% (annualized), the strongest pace since the later part of the pandemic recession in Q3 2020. With core durable shipments data relatively flat, nothing in the monthly data hinted at something of this magnitude. While yay for Q1, the downside is that nearly every capex spending intention component in the Fed survey data points to a significant cutback in business expenditures in the next six months. This was as good as it is likely to get for a while.

Bottom Line for GDP Better Than It Looks

Real government expenditures declined at a -1.5% annualized rate, something we have not seen in almost three years - hat tip to DOGE. Considering the impact of net foreign trade, the spike in inventory accumulation, and stripping out government, real private sector domestic activity grew at a +3.0% annual rate - surprisingly strong! While households feel lousy, the private sector in Q1 showed no signs of weakness.

Economic Outlook

With Q1 worse than expected on the headline, but better-than-expected based on private sector spending, what can we expect in Q2? Well… sentiment and job growth are both pretty grim.

Consumer Confidence

Tuesday’s US Consumer Confidence data from the Conference Board came in weaker than expected, with the present situation index declining 0.9 points. The expectations index plummeted 12.5 points to 54.4, the lowest level since October 2011 and well below the threshold of 80 that typically indicates an imminent recession.

The share of consumers expecting fewer jobs in the next six months reached 32.1%, nearly as high as April 2009, in the middle of the Great Recession. Expectations about future income prospects turned negative for the first time in five years, suggesting that consumers are worrying about their finances. While the decline was seen across all age groups, it was sharpest among consumers between 35 and 55 years old and for households earning more than $125,000 a year.

Labor Market

In March, job openings fell more than expected to 7.19 million, and February’s data was revised downward to 7.48 million. Job openings are now down nearly 5 million (40.7%) from the 2022 peak.

The number of job openings per unemployed person has fallen from a peak of 2.02 to 1.02.

The number of openings is now at new cycle lows compared to the number of “slack” workers who are either unemployed, underemployed, or not in the labor force but want a job. This weakness gives the Federal Reserve some cover for rate cuts. The other good news is that while the number of hires was very weak, back to early 2010s levels, new hires as a percentage of the labor force appear to have stabilized. Quits were also sharply higher this month, implying confidence in finding a job. Layoffs may be rising, but are not rising rapidly, and are well below the 2010s level.

On Wednesday, the ADP private sector employment report for April showed a major miss to the downside. Job growth slowed to +62k, about half the consensus estimate of +115k. This was the weakest pace in nine months. March was also revised downward to +147k from +155k.

Leading Indicators

When the ratio of leading to coincident economic indicators (hat tip Yardeni Research) falls this much, it has historically indicated a recession is imminent. It has only fallen this much once before, in over 60 years, during the Global Financial Crisis.

You have to go back to the 1980s to find Consumer Expectations this low, and current sentiment is also down around historical lows.

The last time wage growth slowed so rapidly was during the Great Financial Crisis, but today’s pace remains elevated. That said, it is the change here that is more impactful versus the absolute level.

My Daily Rant

If the economy contracts again in Q2, that would likely signal a recession. The Fed is already under pressure to reignite rate cuts, but just how effective will they be?

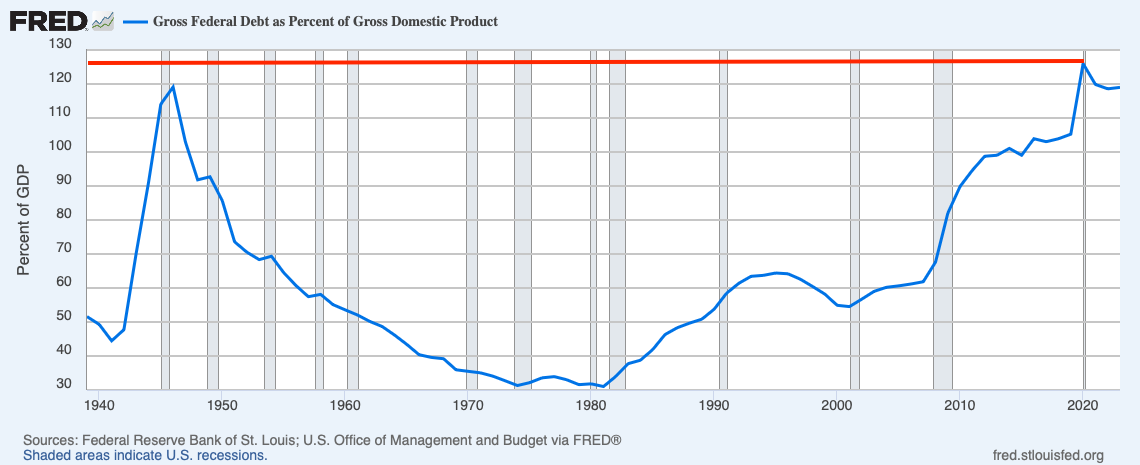

To give a little perspective, gross federal debt relative to GDP has recently shot to all-time highs, well above the levels reached even during WWII. At this level of indebtedness, tax cuts and stimulative monetary policy (rate cuts) have a more muted impact than when debt levels are lower as has been observed and discussed by a line of outstanding economists, including Nikolai Kondratiev, Irving Fisher, Charles Kindlelberger, Hyman Minsky, Carmen Reinhardt, Vincent Reinhardt, Kenneth Rogoff, Andreas Bergh, and Magnus Henrikson.

Rate cuts won’t pack as much of a punch, and fiscal stimulus options are limited with debt at unprecedented levels.

The growth of an economy is a function of just two things: the growth of the labor pool and the growth in productivity.

The domestic fertility rate is crashing, which has spawned all kinds of ideas, from child tax credits to awarding women medals if they deliver enough babies. We live in interesting times. Given that no country seems to have figured out how to ignite baby fever, I’d suggest a more pragmatic approach that doesn’t have an 18+ year lag. Attract international entrepreneurs and offer work visas for the brightest international students. The domestic labor pool isn’t growing fast enough, so import talent.

Regarding productivity, we need innovation, which is supported by political and economic stability AND a more diverse economy. By that, I mean fewer massive employers and more small and medium-sized businesses, so we have more companies experimenting more. The trend we’ve seen over the past few decades of companies getting bigger and bigger and gobbling up any little competitor that dares enter their marketspace makes for less competition, less innovation, and a less resilient economy. How to foster this is a much longer conversation for another time, but it involves better antitrust enforcement and tax code/regulatory environment that is not so burdensome that smaller companies are overburdened, making them less competitive than industry behemoths.

Interesting as always Lenore, but given your comments about capital spending I'm a little surprised/disappointed there was no discussion about AI and data center capex. Last week Google reiterated its capital spending plans as did Microsoft last night, while Meta lifted its spending plans. Looking forward to your thoughts on this and what you think it means for the market's mood when it comes to tech stocks.